Event Information

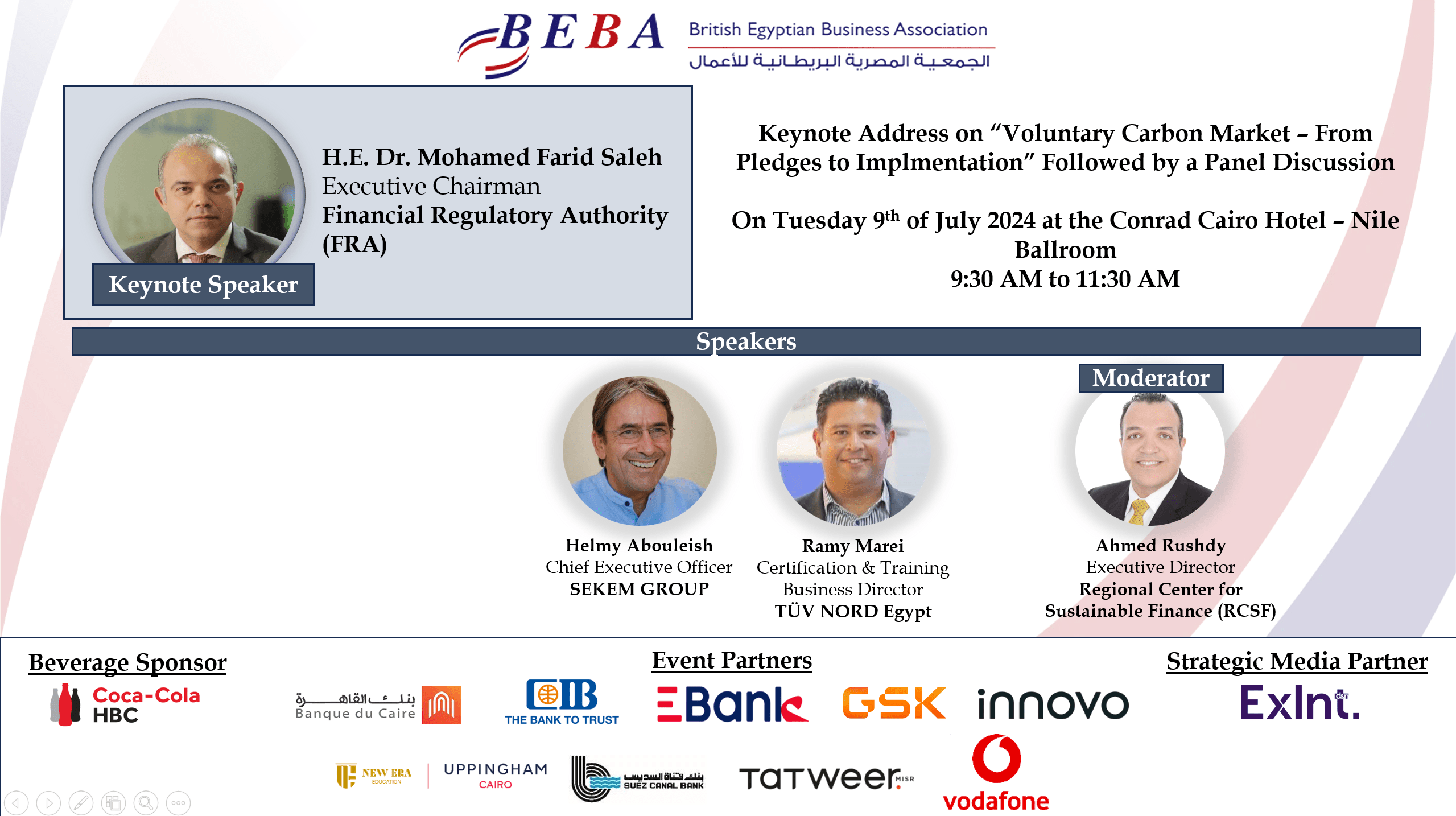

The British Egyptian Business Association (BEBA) organised a Keynote Address on “Voluntary Carbon Market – From Pledges to Implementation” Followed by a Panel Discussion.

with H.E. Dr. Mohamed Farid Saleh, Executive Chairman, Financial Regulatory Authority (FRA)

The event was held on July 9th – 2024, at the Conrad Cairo Hotel – Nile Ballroom.

On July 9th, 2024, BEBA organized an event where a keynote address titled “Voluntary Carbon Market – From Pledges to Implementation” was delivered by H.E. Dr. Mohamed Farid Saleh, Executive Chairman of the Financial Regulatory Authority (FRA). The event, moderated by Mr. Karim Helal, President of Concord International Investment took place at the Conrad Cairo Hotel. Dr. Farid’s address offered a comprehensive overview of carbon markets, their evolution, their potential role in tackling climate change, as well as Egypt’s participation in carbon markets.

Evolving Carbon Markets

The address began with a historical perspective on carbon markets. Dr. Farid explained the concept, tracing its roots back to the 1997 Kyoto Protocol and the Clean Development Mechanism (CDM). While the CDM played a pioneering role, it ultimately faced limitations. To address these shortcomings, the Paris Agreement introduced Article 6.2, paving the way for a new generation of carbon certificate markets. Dr. Farid has also emphasized the increasing frequency of extreme weather events, highlighting the urgency for action.

Two Key Types of Carbon Markets

Dr. Farid highlighted the two primary types of carbon markets:

- Compliance Carbon Markets (CCM): These markets are government-regulated where sectors controlled by the country are subject to emissions caps.

- Voluntary Carbon Markets (VCM): These markets cater to companies with projects that actively reduce CO2 emissions. Companies can earn financial returns (referred to as “sweeteners”) through the issuance and sale of carbon certificates.

Egypt’s Steps to Participate in the Voluntary Carbon Market

Dr. Farid outlined the steps Egypt is taking to participate in the voluntary carbon market:

- Leveraging International Models: Egypt will establish its carbon certificate market by following successful models already implemented internationally. This ensures a robust and efficient system from the outset.

- Project Design Documentation: Project developers will work with environmental consultants to prepare project design documents. These documents will be crucial for accurately measuring emission reductions.

- Verification and Validation:

- Verification bodies will then assess the project design documents to ensure they genuinely aim to reduce CO2 emissions.

- Validation bodies will take pre-project emission measurements to establish a baseline. After project implementation, they will measure post-project emissions to verify the achieved reductions.

- Issuing Carbon Certificates: If the verification and validation process confirms the project’s effectiveness in reducing emissions, the project can then issue carbon certificates. Each certificate represents one tonne of CO2 equivalent (CDE) offset.

- Trading Platform: Africarbonex serves as the platform for trading and selling carbon certificates in the Egyptian stock market.

Financial vs. Commodity Classification

Dr. Farid has clarified the classification of carbon certificates in Egypt. While internationally they may be viewed as commodities, within the Egyptian regulatory framework, they are considered as a financial instrument in the form of securities.

Challenges in Verification & Validation

- Lack of Awareness: A significant challenge identified by Dr. Farid was the limited awareness of Verification and Validation Bodies (VVBs) amongst potential participants.

- Stringent Requirements: Becoming a VVB requires obtaining three ISO certifications (14064, 14065, and 17029) along with a proven track record. This can be a hurdle for some institutions.

Solutions Implemented:

- Regulations for VVB Registration: Egypt established clear regulations for registering as a VVB, outlining the ISO certification requirements.

- Establishment of EGAC: To address the need for local VVBs, the Egyptian Accreditation Council (EGAC) was introduced. This body can accredit institutions to become verifiers and validators.

- Foreign VVB Recognition: Recognizing the initial gap, Egypt allows foreign VVBs registered with reputable entities like Gold Standard, VERRA, and GCC to operate within the country.

Impact of a Local VVBs Market

The introduction of a local VVBs market can potentially address a key concern as discussed by Dr. Farid:

- Cost Reduction for Project Developers: The initial requirement for projects to utilize foreign VVBs could have inflated costs, particularly for medium-sized enterprises. A local market with potentially lower fees can encourage wider participation.

Project Registration and Visibility

- Streamlined Registration Process: Regulations for project registration are readily available, allowing project developers to initiate the process early.

- Certification as a Stepping Stone: Obtaining a carbon credit certificate can act as a pre-qualification step, demonstrating a project’s commitment to reducing CO2 emissions and potentially increasing visibility for potential investors.

Key Points from the Q&A Session to Dr. Farid

- Carbon Market Demand: Farid indicated that the demand for carbon markets is not a cause for concern; as financial institutions are increasingly looking to support projects that reduce emissions, creating a potential market for carbon credits.

- Corporate Sustainability Goals: Many companies, both multinational and local, are setting ambitious zero-emission targets, driving demand for carbon offsetting solutions.

- Price Differentiation: Farid has also highlighted the possibility of a price premium for projects that not only reduce CO2 but also contribute positively to one or more of the Sustainable Development Goals (SDGs).

The event provided a glimpse into the promising future of Egypt’s Voluntary Carbon Market, thanks to the insightful address by Dr. Mohamed Farid Saleh. Dr. Farid outlined a clear roadmap for the market’s development, leveraging successful international models as a foundation. The establishment of a robust regulatory framework and the Egyptian Accreditation Council (EGAC) represent significant advancements in creating a transparent and trustworthy market.

Dr. Farid readily acknowledged remaining challenges, such as public awareness of Verification and Validation Bodies (VVBs) and potential project costs. However, his insights highlighted the strategic approach Egypt is taking to address these concerns such as allowing participation of established foreign VVBs alongside fostering a local market through EGAC demonstrates a commitment to both efficiency and domestic capacity building.

By addressing these challenges and continuing to raise market awareness, Egypt is well-positioned to attract project developers and become a key player in the global carbon market.